The 4 Most Common Term Options for Private Money Loans

Financing is the biggest hurdle real estate investors face.

Most average investors don’t have a lot of cash on hand, so alternative financing is required. This usually means getting a loan. So unless you have a rich uncle that agrees to fund his favorite nephew’s real estate adventure, head to the bank or find a private money lender.

With the state of the economy and tightened financial markets, the use of private money lending has been skyrocketing.

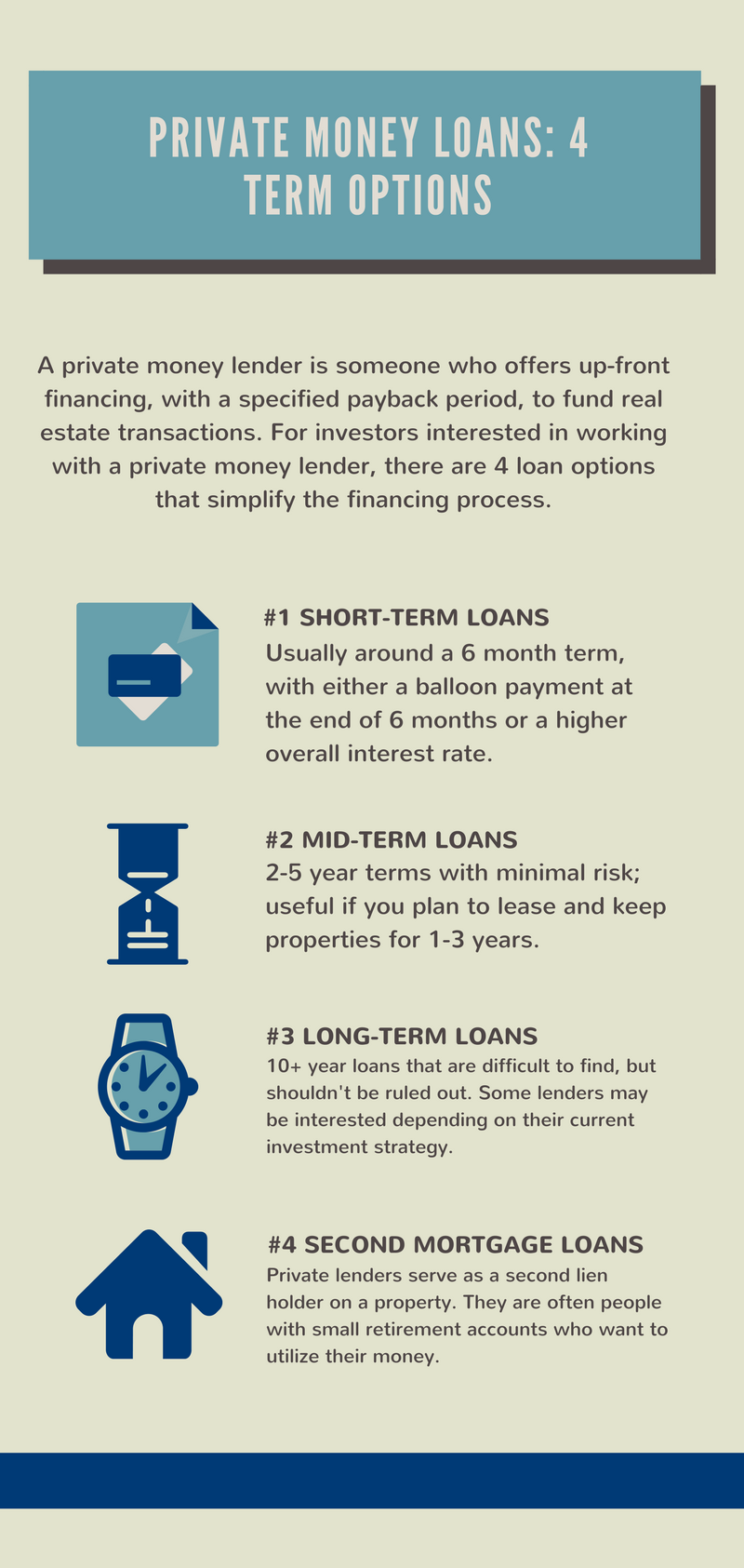

A private money lender is an individual who offers up-front financing with a payback period to fund real estate transactions. Are you interested in working with a private money lender? If so, read on to learn the 4 most common loan term options that simplify the financing process.

1. Short-Term Loans

As opposed to a traditional loan, the short-term route is only about 6 months.

Repayment comes with different options. You may offer to make monthly interest payments with a balloon payment at the end of the 6 months. Or you can choose not to make interest payments at all and pay a higher interest rate on the loan. If you choose the latter, you’ll just have the one balloon payment after the property has been sold. Since there’s a vast amount of flexibility, it’s just a matter of understanding what is important to the lender.

Trust may be the determining factor. Some lenders require monthly payments at first. Then when that loan is paid off they are ready to invest again. At that time they may be willing to wait the entire 6 months without payment.

2. Mid-Term Loans

If you plan to keep leased properties for 1-3 years, a mid-term interest-only loan may suit you.

This type of loan typically lasts for 2-5 years and comes with a minimal amount of risk. Depending on the lender, you may have to pay off the property on a short-term basis or choose to refinance. At that point, you can either go with a conventional loan if refinancing or switch to another private lender altogether.

3. Long-Term Loans

For the “buy and hold” investor, it can be difficult to obtain an extended loan from a private money lender. These lenders are harder to find, but they do exist and ruling them out could cancel good opportunities for you.

If you’re offering an interest rate of 6%, some lenders may be interested depending on their current investment strategy.

4. Second Mortgage Loans

Finally, there’s the option of using private lenders to serve as a second lien holder on a property. If you were to need a loan to do renovations to your home, there are lenders available to help. They will loan you money for this and simply hold your second mortgage.

There are quite a few people who have retirement accounts and would like to utilize their money in real estate. For them, the second mortgage loan is the perfect type of loan.

Make sure you have positive equity. That way if the property is ever foreclosed on, your lender would still get their money back.

In conclusion…

A private money lender can allow for efficiency of the most difficult aspect of the investing process, which is financing.

If you’re ready to start your real estate investing career, keep these 4 terms options in mind. Don’t neglect to educate your private lenders about each one.